July 5, 2022

Connor Waldoch, Former Senior Manager, Policy & Regulatory Affairs

Connor Waldoch, Former Senior Manager, Policy & Regulatory Affairs

Connor Waldoch, Former Senior Manager, Policy & Regulatory Affairs

Welcome to the second half of our breakdown of the impacts of NYISO’s recent FERC Order No. 2222 compliance filing on DER aggregation. You can read the first post here.

What Can Participate - and How?

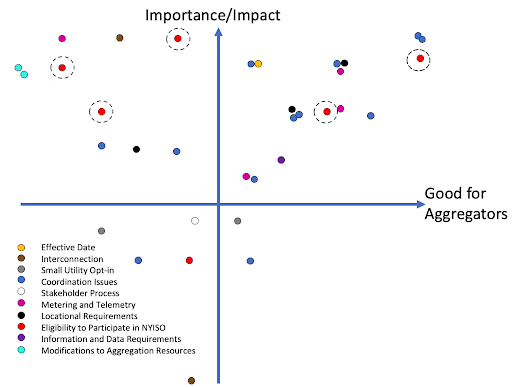

Now that we’ve discussed some of the most and least positive impactful sections of the Order, let’s review the most disparate, the red markers: Eligibility to Participate.

Operational Requirements Cut Both Ways: Dispatchability and Ancillary Services

Let’s start off with a downer for energy efficiency (EE) - FERC declined to do anything around requiring or encouraging NYISO to accommodate EE and allow it to participate in NYISO’s capacity market. This is the rightmost red dot in the upper left quadrant. While it is quite bad for explicitly EE organizations (hence the high impact rating), EE has never been allowed to sell capacity in the NYISO and it was always unlikely that advocacy on this front would yield anything beyond summary dismissal as out of scope for Order 2222. Additionally, EE has a contentious history in capacity markets and is not a resource type we work with at Leap.

Continuing with the less-than positive news: a pair of items related to what an aggregation can be considered. First, FERC disagrees with protestors stating that the NYISO must allow homogeneous aggregations the opportunity to participate under the DER aggregation model rather than the model designed for their specific technology. This means that an aggregation comprised entirely of energy storage resources must comply with the specific requirements of participation associated with energy storage, regardless of individual differences between the resources.

Second, and the furthest left on the above graph, is FERC’s support of NYISO’s stance that heterogeneous aggregations must be fully dispatchable, just as traditional generators are. Under this interpretation, an aggregation containing mostly intermittent solar resources and a single battery will be required to adhere to strict bidding and operation standards regardless of the battery’s ability to cover the entire range of operations. The broad stance taken here is that “the addition of an electric storage resource” will enable an aggregation to follow dispatch instructions from the NYISO. This does, however, assume that said storage resource has been perfectly sized in order to accommodate a potential future range of wholesale market participation.

Overall, these two decisions place some constraints on configuring aggregations and will certainly have an impact on the decision making process around which resources decide to participate and when.

Wins for Aggregators

Finally, we come to the positive news! First we’ll address the biggest win for Aggregators in this section: FERC has required NYISO to recognize the ability of heterogeneous aggregations to sell the ancillary services they can actually provide. Previously, NYISO filed an intent to only accept the abilities of the least capable DER in an aggregation, completely ignoring any more capable member of an aggregation.

In the NYISO’s original filing, if only 2 MW out of a 5 MW aggregation could provide regulation, the entire aggregation would be barred from selling that ancillary service. Industry rightfully protested that NYISO had not shown a strong technical reason for this requirement, only claiming an undefined “reliability risk.” FERC determined that the balance between NYISO’s original filing and Order 2222 would be to provide the NYISO additional time to implement this requirement. This is the single item which may not be implemented alongside the rest of NYISO’s 2222 compliance. NYISO will follow up with a proposed date for filing their actual compliance on this topic within 60 days.

The second win in this area relates to potential double counting, the issue of Aggregators selling the same aggregation to provide the same services in both retail and wholesale markets. To be extremely clear, this is not an issue of dual participation in general - which is allowed and actually key to stacking value for small resources - but an issue of resources providing the exact same service in two different markets. This is already accounted for in current practice, for example, a resource taking the Value of Distributed Energy Rate (VDER) in New York cannot receive the capacity portion of VDER and also receive revenue from participation in the NYISO’s capacity market.

The issue at stake in the NYISO’s filing was unclear language with the potential to create regulatory uncertainty. The original NYISO language on double counting concerned any DER that “provides the same or substantially similar service in a retail market or program.” FERC agreed with industry complaints that the phrase was ambiguously worded, ordering NYISO to delete “substantially similar” and clarify in any other relevant section that the service in question must be the same, not just similar.

Final Thoughts

Although the final compliance filing is still to come, and the heterogeneous ancillary services portion remains further away, NYISO is now very close to the 2222 finish line - closer than we thought only a few weeks ago. While the order is something of a mixed bag, overall it has positive implications for Aggregators.

One broadly positive takeaway is FERC’s repeated instruction to the NYISO to incorporate specific details and requirements directly in tariff. Far too often ISO/RTOs will kick the detail can down the road, eventually populating myriad technical bulletins and manuals with details that could, and should, be centralized. That centralization not only provides a definitive path for market participants, but enforces a higher level of whole-tariff agreement in general. When crucial market requirements live in siloed documentation, they tend to drift from pure tariff compliance over time. We hope this trend encourages more thoughtful integration with the NYISO’s existing market models and less potential for conflict in the documentation moving forward.