August 22, 2024

California’s battery storage market is booming, yet current wholesale energy market rules offer little incentive for behind-the-meter batteries to participate. By our estimate, less than 1.5% of residential batteries installed in California participated in third-party wholesale market programs last year. There are a number of reasons for this, but one major issue is the lack of a scalable mechanism to compensate them for exporting excess energy to the grid.

That may be about to change.

Last month, the California Independent System Operator (CAISO) released its 2024 Policy Catalog, a list of all the policy initiatives that stakeholders have proposed to improve the functioning of California’s wholesale market. This year, as part of its newly-revamped Policy Initiative Roadmap Process, CAISO did something different: they invited stakeholders to provide input on which draft Catalog entries they thought CAISO should prioritize. The final Catalog not only includes the proposed initiatives, but also how many stakeholders prioritized them.

Leap was excited to see one of our own policy proposals, the Modified Proxy Demand Resource (mPDR) mechanism, included in the draft Policy Catalog. Initially conceived by California regulators, mPDR would allow distributed batteries participating in CAISO to be compensated for energy that they send back to the grid, rather than just their ability to reduce load onsite. Currently, CAISO will “zero out” battery-to-grid exports at the meter level, effectively eliminating any incentive for batteries to discharge more power than can be consumed on-site.

Under mPDR, DR performance would be measured at the Sub-LAP level rather than the meter level. When batteries send power back to the grid, they would reduce overall load at that Sub-LAP, improving that Sub-LAP’s performance in a DR event. In other words, by making a simple change to how demand response performance is measured, CAISO would provide an incentive for batteries to export additional capacity, unlocking hundreds of MW of new capacity for the California grid.

From Thought Exercise to High Priority

Despite the potential value, mPDR essentially just existed as a thought exercise until Leap, in collaboration with Renew Home and the California Energy + Demand Management Council, submitted it as an official proposal in CAISO’s policy initiative process. Now, not only has mPDR been officially added to CAISO’s Policy Catalog, but the final Catalog reveals that it’s also a high priority for many other market stakeholders.

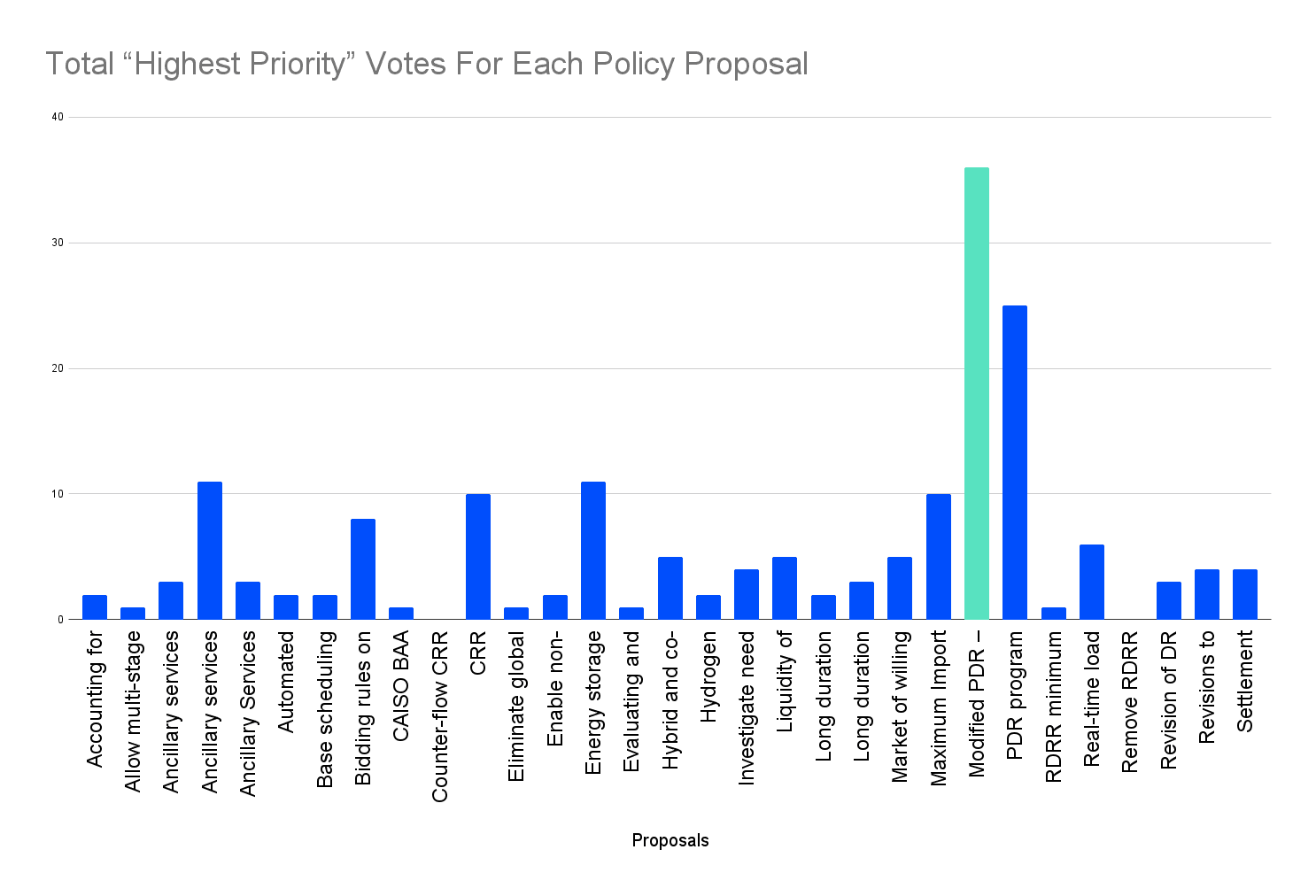

The mPDR proposal (highlighted above) received the most “highest priority” votes from stakeholders, followed by another proposal focused on “PDR program enhancements,” which includes reforms that would make mPDR easier to implement (descriptions of each initiative are available in the Policy Catalog appendix). These votes are collectively a huge vote of confidence in the importance of mPDR not just to the DR industry, but also to the broader stakeholder community.

Broad-Based Support

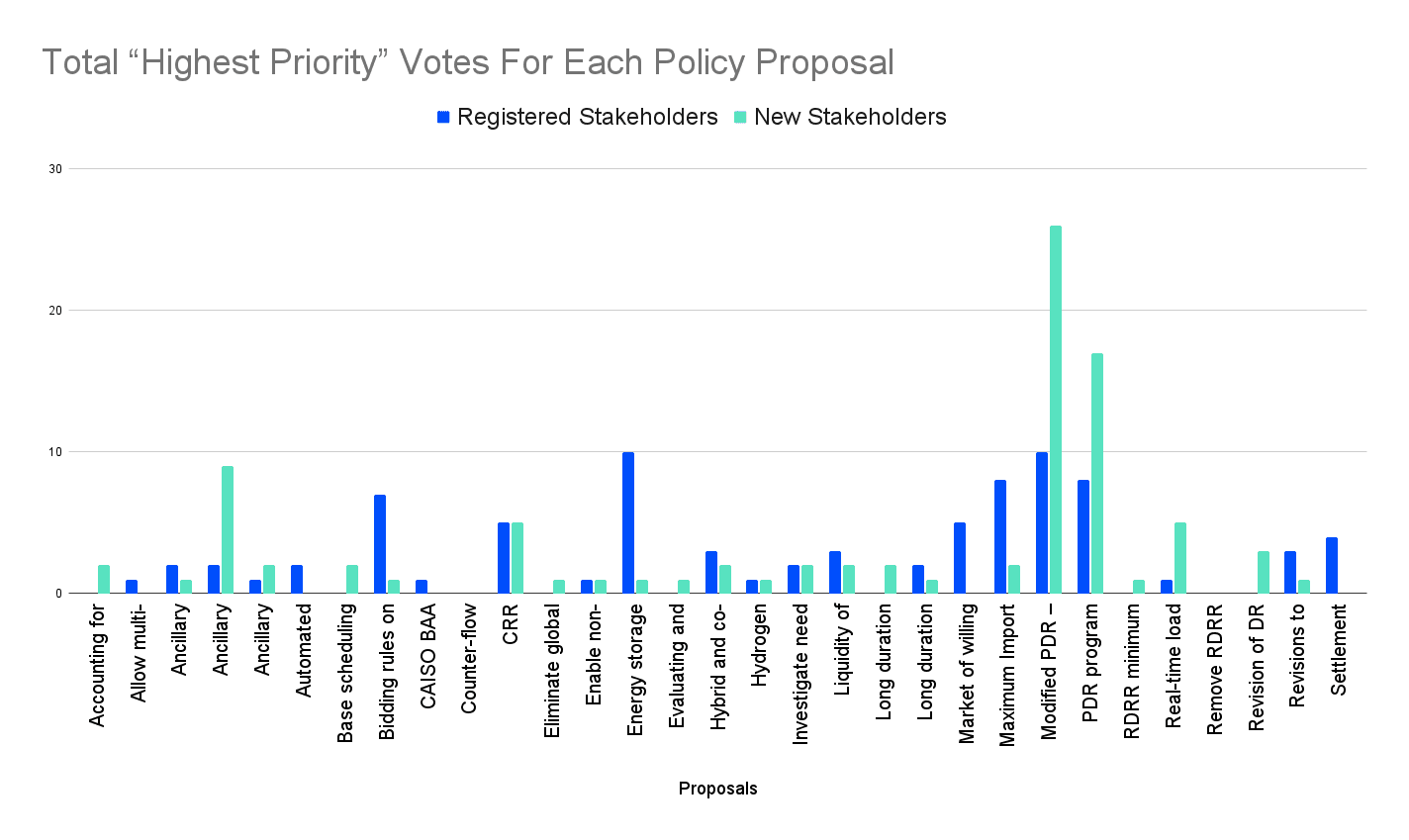

This support for mPDR is noteworthy because, despite the term “vote,” CAISO’s policy selection process is not based on a simple majority. CAISO’s list includes both large and small players in the energy market, and CAISO tends to weigh feedback from larger players more heavily. This difference between stakeholders is somewhat illustrated when separating the “highest priority” votes into “registered” and “new” stakeholders, since the latter group contains stakeholders that don’t engage with CAISO regularly but may have been motivated by a specific issue.

This chart shows that mPDR (and its companion proposal, “PDR Program Enhancements”) was a particular favorite among new stakeholders. Although some of these new stakeholders may be smaller, it’s significant that mPDR received such broad-based industry support, bringing in feedback from groups that are generally less involved in CAISO’s stakeholder processes.

Even looking just at votes from registered stakeholders, it’s clear that mPDR was one of the highest-priority initiatives. Support for mPDR also expands far outside the DR sector, garnering “high priority” votes by both the Energy Division and Public Advocates Office at the California Public Utilities Commission (CPUC), as well as large utilities like PG&E and Arizona Public Service.

What’s Next?

Stakeholder prioritizations are just one factor - alongside other concerns like feasibility and bandwidth - that CAISO considers when determining which policies they will implement, and it’s likely that they’ll take into account who supported specific proposals rather than simply how many votes an option received. However, if the purpose of these stakeholder rankings was to determine which proposals had the widest support, then the results are clear: no matter how you break down the data, mPDR surfaces as a major stakeholder priority.

Now it’s up to CAISO to make it happen. We’ll get our next update in late September, when CAISO intends to release its draft Policy Roadmap. This Roadmap will identify a subset of the policy initiatives from the Catalog to set up for implementation in 2025 and beyond.

Given the overwhelming stakeholder support, it’s hard to imagine mPDR not making the cut. Stay tuned.